Medical Benefits

Welcome

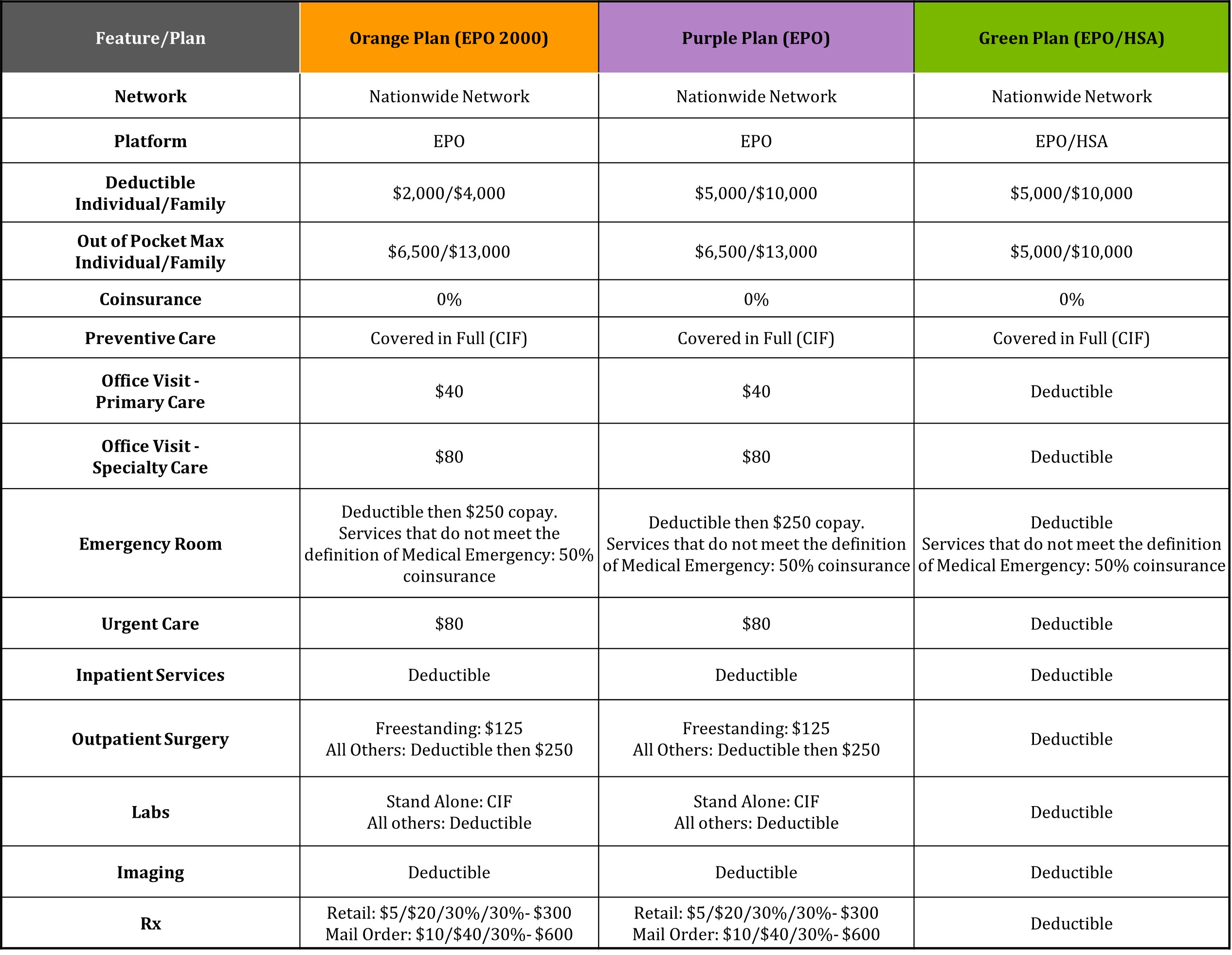

Monadnock Food Co-op’s Health Insurance plans are administered by Health Plans, Inc. Monadnock Food Co-op offers 3 plans including the new Orange Plan, Purple Plan (EPO), and the Green Plan (EPO/HSA).

Eligibility

All regular employees working 30+ hours a week are eligible to enroll in Health insurance. Eligibility for newly hired employees is first of the month, following 60 days of full employment.

Benefit Information

How do I enroll?

To enroll, all employees will submit benefit elections through Paylocity’s Bswift Benefits Portal. Newly hired, regular employees who work at least 30 hours per week will enroll for health insurance benefits during the new employee orientation period. Eligibility begins on the first of the month following 60 days of employment.

Open Enrollment is your opportunity to make new benefit elections or changes to your current benefit selections.

If you miss the new hire or open enrollment window, you will have to wait until the next open enrollment to enroll in benefits unless you experience a qualifying life event.

Cost To Use –

A Copay is an amount set under the medical plan that the member pays for covered services – such as an office visit – or prescription drugs. The Orange and Purple plans have copays for office visits and Rx.

Deductible is the amount of deductible-eligible covered medical expenses (e.g. inpatient, outpatient, imaging, lab, ER) the member pays before Health Plans, Inc. pays benefits. The Orange plan has a $2,000 individual deductible and $4,000 family deductible. The Purple and Green plans have a $5,000 individual deductible and $10,000 family deductible. On the green plan, ALL services and Rx are subject to the deductible.

Coinsurance is the amount the member pays for deductible-eligible services after meeting the deductible. None of the plans have coinsurance for most medical services, only Durable Medical Equipment, and some Rx. Under all plans, you will be responsible for coinsurance for any Emergency Room charges that do not meet the definition of a Medical Emergency.

Out of Pocket Maximum refers to the most you will pay for covered expenses under the plan. Copays, Deductibles and Coinsurance all accumulate toward the OOP Max. The green plan has the lowest OOP Max; purple plan, the highest.

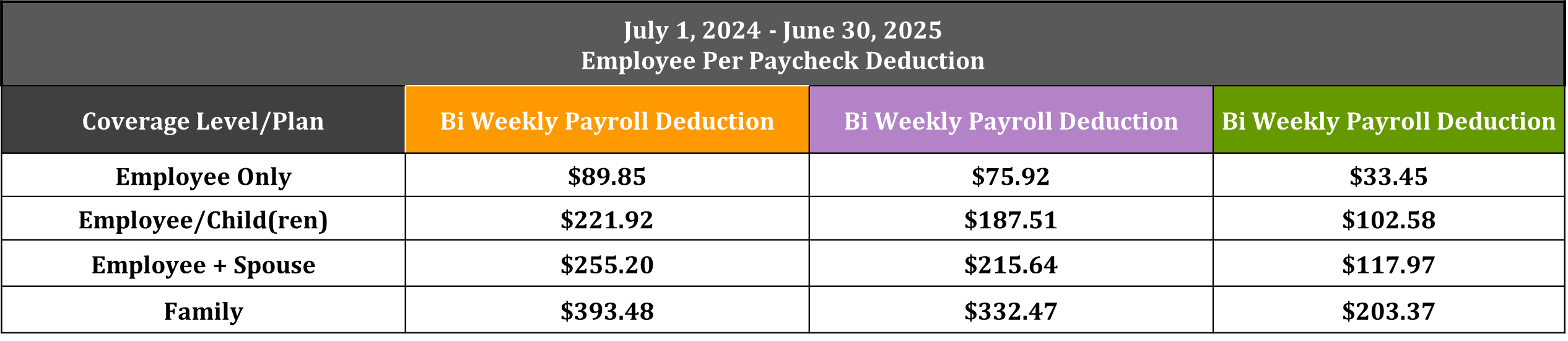

Cost To Own – The plan summary and amounts that will be deducted from each paycheck is listed below.

Contributions & Rates

Summary of Benefits & Coverages

When choosing a Health Insurance plan that is right for you and your family, there are 3 things to consider.

Network –

All three plans operate on the same Nationwide Network of Providers. The plans access Harvard Pilgrim’s vast provider network for care both locally and across New England. When requiring care outside of New England, members will access the United Healthcare Options network.

To locate in-network providers, log into www.healthplansinc.com.

• After clicking “HPHC and UnitedHealthcare Options” you will be asked to “Select a Plan”.

• Choose PPO.

• Please note: The Co-op’s plans are EPOs (rather than PPOs), but providers are searched using the PPO network.

Waiving or Declining Health Insurance

If you are eligible for health insurance and will not be enrolling because of alternative coverage, or choose not to have insurance, a waiver form must be signed during the enrollment period. If you elect not to enroll, you may not join the plan until the next Open Enrollment period, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections, outside of the normal, Open Enrollment period. Examples of Qualifying Life Events include: the birth of a child, marriage, divorce and a loss of other coverage.

All employees should be aware of possible Federal tax penalties for declining Monadnock Food Co-op’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave Monadnock Food Co-op?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

Summary Plan Description (SPD)

Summaries of Benefit Coverage (SBC’s)

Prescription Summaries

Additional Resources

Health Savings Account

Health Savings Account (HSA)

What is a Health Savings Account (HSA)?

An HSA is a triple-tax-advantaged trust/custodial account that eligible individuals can use to pay for qualified medical, dental & vision expenses for themselves or their tax dependents.

Who is eligible?

Enrollment in the HSA is automatic when you enroll in Monadnock Food Co-op’s Green Plan (EPO/HSA).

How it works:

Triple-tax-advantaged: Contributions are pretax, contributions accumulate tax-free, distributions for qualified expenses are tax-free.

Contributions may be made either through payroll deduction or directly to Health Equity from your personal account.

Contribution limits in 2024, are $4,150 for single coverage; $8,350 for dual/family coverage. If age 55+ additional $1,000.

You may pay for eligible expenses with the debit card issued by Health Equity, or using another form of payment and requesting reimbursement from your HSA.

Funds in your HSA account will accumulate and grow until you remove them. If your employment ends at Monadnock Food Co-op, your account can remain with Health Equity. If you enroll in another HSA-eligible health insurance plan, and remain eligible to make contributions, you may resume contributions. If you are not enrolled in an HSA-eligible health insurance plan you may use the funds to pay for qualifying medical expenses but will be unable to make future contributions.

While your HSA account belongs to you, and you may use the funds for any purpose, withdrawals/distributions for purposes other than qualifying medical expenses while be taxed as ordinary income and subject to a 20% penalty tax before age 65. After age 65, 20% penalty is not assessed, but distributions for expenses other than qualified medical will be taxed.

For convenience, Monadnock Food Co-Op has established a relationship with HSA custodian Health Equity. www.healthequity.com.

Enjoy lower Health plan premiums

HSA-qualified health plans offer lower premiums, enabling you to save potentially thousands every year. Establish Long-term savings by putting the extra money you would’ve paid toward traditional premiums into your HSA.

HSA funds roll over

Your entire HSA balance rolls over every year—even if you change health plans, retire, or leave your employer.

HSAs offer expanded coverage options for consumers

Unlike typical insurance plans that have a highly negotiated list of medical products or services that are covered, HSAs allow many additional health-related expenses. So doctors’ visits, hospital expenses and prescriptions are covered, but coverage also extends to some dental and vision services, and certain “non-traditional” treatments such as acupuncture and deep tissue massage.

HSA’s allow you to be a savvy consumer

- HealthEquity debit card is an easy way to pay at the pharmacy or doctor’s office. Just run it as a credit card—no PIN required.

- Consumers have unlimited choices regarding services, service providers and medical expenditures. You can comparison shop for services.

- Because an HSA is a “cash” account, it empowers consumers with an option to negotiate pricing on many medical services, which can lead to substantial savings on medical expenses

An HSA can be a Retirement Engine

Unlike other account types, an HSA lets you invest money to build the ultimate retirement nest egg.

- Invest in low-cost mutual funds, just like a 401(k) Retirement Account

- Make tax-free contributions and grow tax-free earnings on those contributions

- An HSA lets you take tax-free distributions for qualified medical expenses. After age 65 you can use your HSA for any expense, you’ll simply pay ordinary income taxes—just like a 401(k)

Carrier Contact Information

Health Equity: Health Saving Account (HSA)

Customer Service: 866-346-5800

Website: www.healthequity.com

Forms and Plan Documents

HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Health Spending Account.

Did you know you could use your HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

Dental Benefits

Eligiblity

All employees who work a minimum of 20 hours per week are eligible, first of the month, following 60 days of employment.

Summary of Benefits and Coverages

Plan Overview

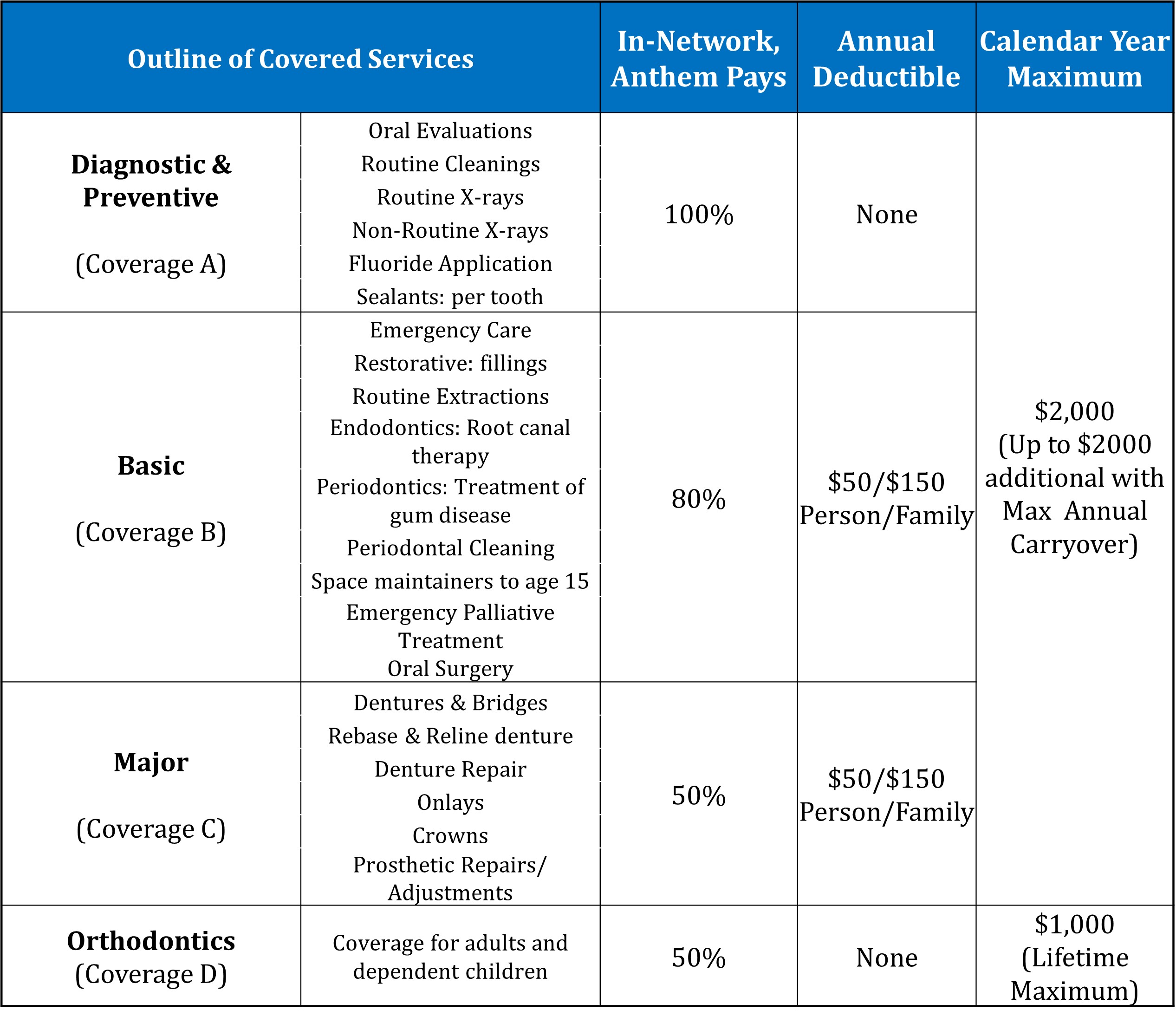

Monadnock Food Co-Op offers it’s employees the Classic Dental plan through Anthem. The plan covers Preventive Care, Minor, Major Restorative and Orthodontic procedures.

The chart below provides a high level overview of the dental plan design and features offered to eligible employees by Monadnock Food Co-op.

When considering whether purchasing dental insurance makes sense for you and your family, there are three things you should consider:

Network – Anthem has a network of providers who have agreed to and will not bill for more than Anthem’s Maximum Allowable Charges for covered procedures. If you visit a non-participating (Out-of-Network) dentist, you may be required to submit your own claim, pay for services at the time they are provided and be responsible for any charges that exceed Anthem’s Maximum Allowable Charges.

Cost to Use – There is no deductible for Preventive Services or Orthodontic Services. All other covered services will be subject to the Individual deductible of $50 or Family deductible of $150.

The annual maximum Anthem’s Classic Dental plan is $2,000 per member. The annual maximum may be increased to as much as $3,000 per person with Anthem’s Maximum Carryover Feature. See the attached Certificate for more information.

After meeting the deductible, you will be responsible for 20% of the cost of in-network Basic services, 50% of Major services, and 100% of all services once you’ve reached your annual max of $1,000, unless you benefited from Anthem’s Maximum Carryover Feature.

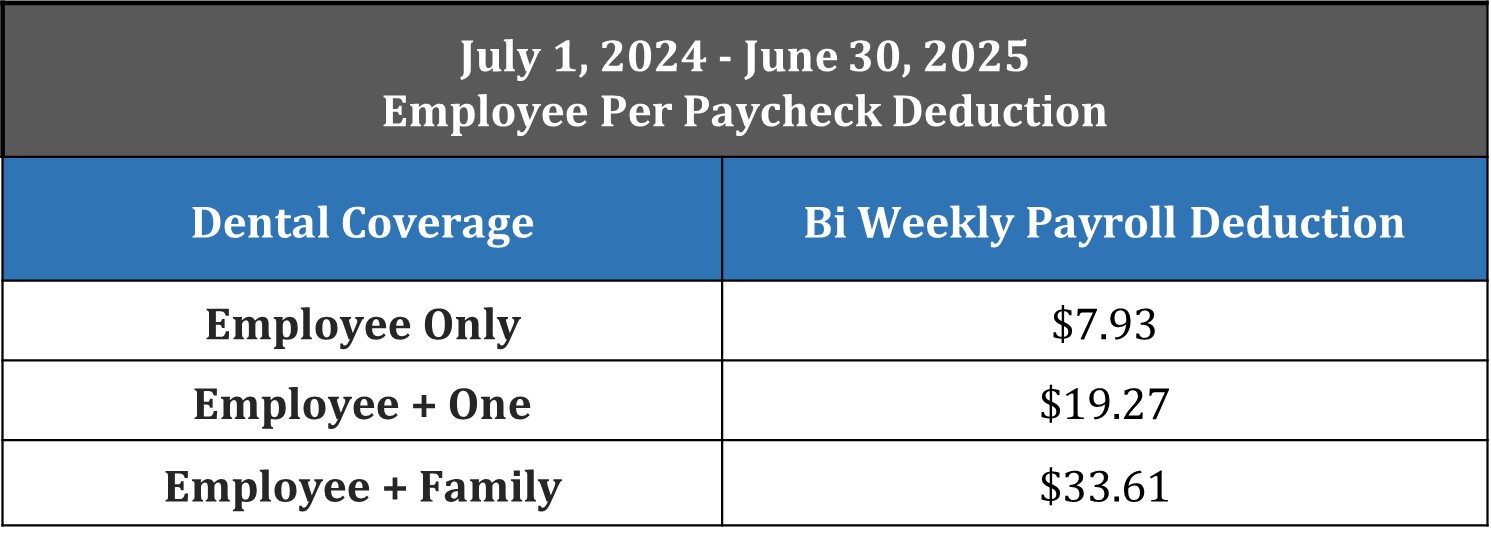

Cost to Own – What will your per paycheck deduction be? The amount that will be deducted from each paycheck is listed below.

Contributions & Rates

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to an FSA be a less expensive way for you to pay for dental care?

Find a Provider

To locate providers, visit https://www.anthem.com/find-care/. You can select Log in for a personalized search or scroll down and select Basic search as a guest and then follow these steps:

- Select “Dental Plan or Network”.

- Choose your State.

- Select “Dental” as how you get health insurance.

- Select “Dental Complete” as your plan or network and click “Continue”.

- In the search bar at the top where it asks for “City, County, or ZIP” enter relevant information. Ex. “Keene, NH”

- Select the type of care you are in need of. Ex. “Dentist”

- A list of dental professionals within 20 miles of the location you entered will be displayed.

How do I enroll?

All dental insurance enrollments or waivers must be completed through Paylocity’s Bswift Benefits Portal.

Newly hired, regular employees who work at least 20 hours per week, will enroll for dental insurance benefits during the new employee orientation period. Eligibility begins on the first of the month, following the 60 days of employment.

Carrier Contact Information

Anthem Blue Cross Blue Shield: Dental Insurance

Customer Service: 800-331-1476

Website: www.anthem.com

Plan Documents

Vision Benefits

Eligiblity

All employees who work a minimum of 20 hours per week are eligible, first of the month, following 60 days of employment.

Summary of Benefits and Coverages

Plan Overview

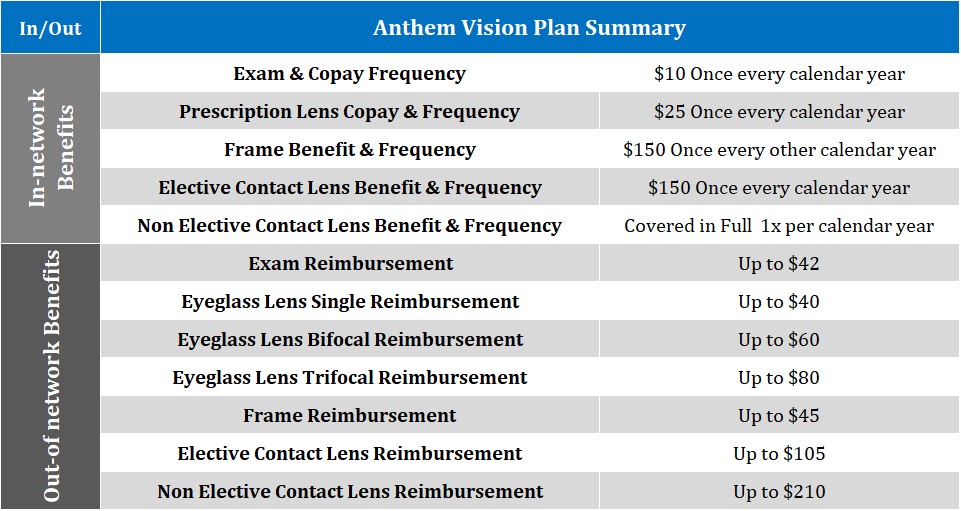

Monadnock Food Co-Op offers it’s employees a voluntary vision plan through Anthem.

The plan provides in and out-of-network benefits as summarized in the chart below.

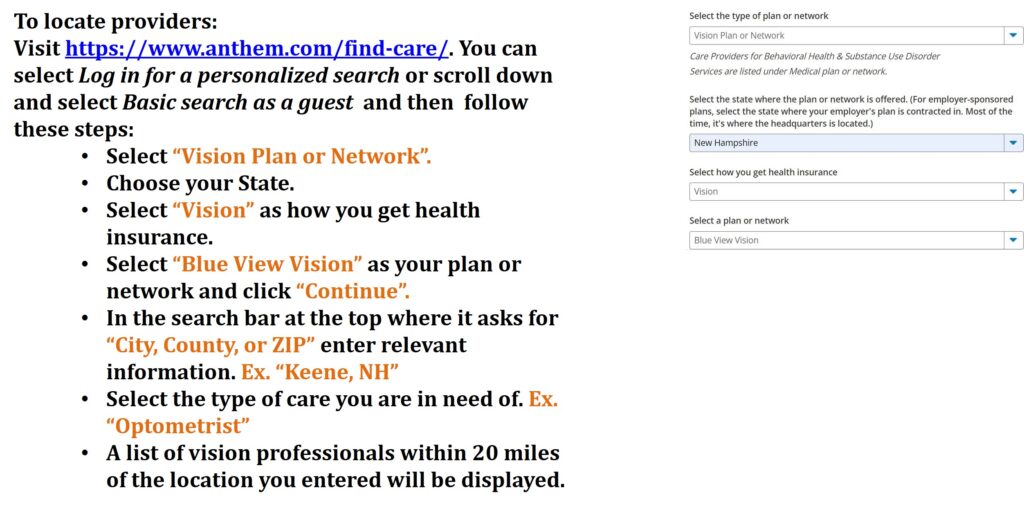

To locate providers:

Visit https://www.anthem.com/find-care/. You can select Log in for a personalized search or scroll down and select Basic search as a guest and then follow these steps:

- Select “Vision Plan or Network”.

- Choose your State.

- Select “Vision” as how you get health insurance.

- Select “Blue View Vision” as your plan or network and click “Continue”.

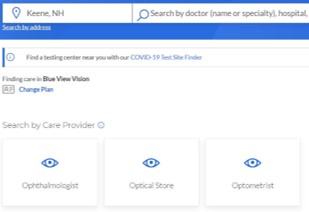

- In the search bar at the top where it asks for “City, County, or ZIP” enter relevant information. Ex. “Keene, NH”

- Select the type of care you are in need of. Ex. “Optometrist”

A list of vision professionals within 20 miles of the location you entered will be displayed

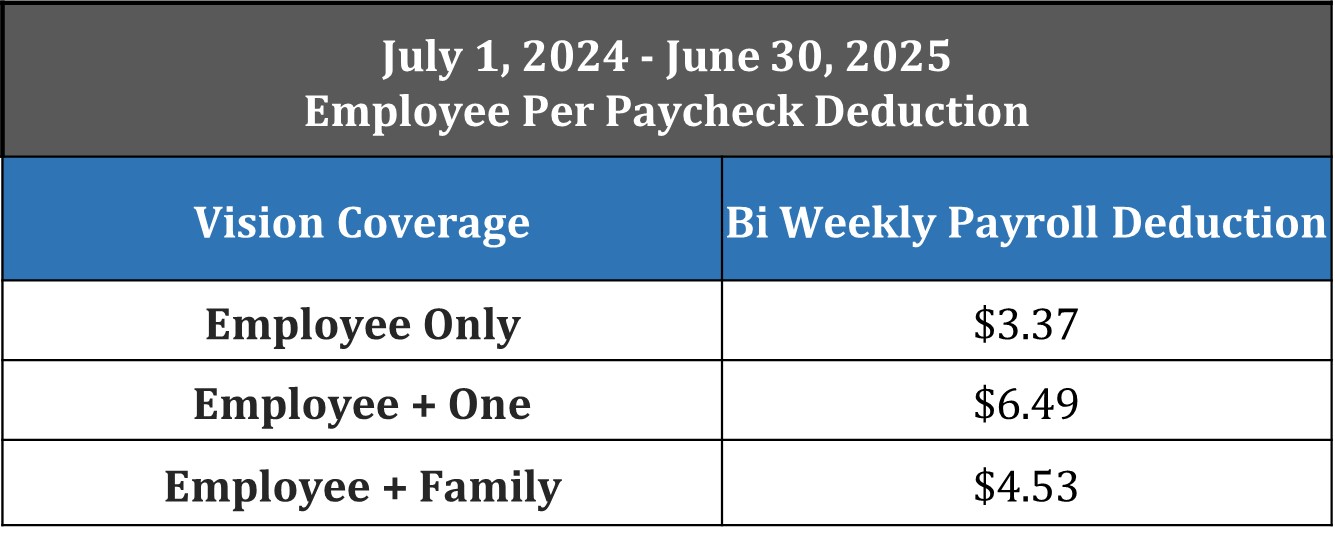

Rates

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

How do I enroll?

All vision insurance enrollments or waivers must be completed through Paylocity’s Bswift Benefits Portal

Newly hired, regular employees who work at least 20 hours per week, will enroll for vision insurance benefits during the new employee orientation period. Eligibility begins on the first of the month, following the 60 days of employment.

Carrier Contact Information

Anthem Blue Cross Blue Shield: Vision Insurance

Customer Service: 800-331-1476

Website: www.anthem.com

Plan Documents

Group Life Insurance

Eligibility

All active, employees who work 20+ hours per week are eligible, first of the month, following 60 days of employment.

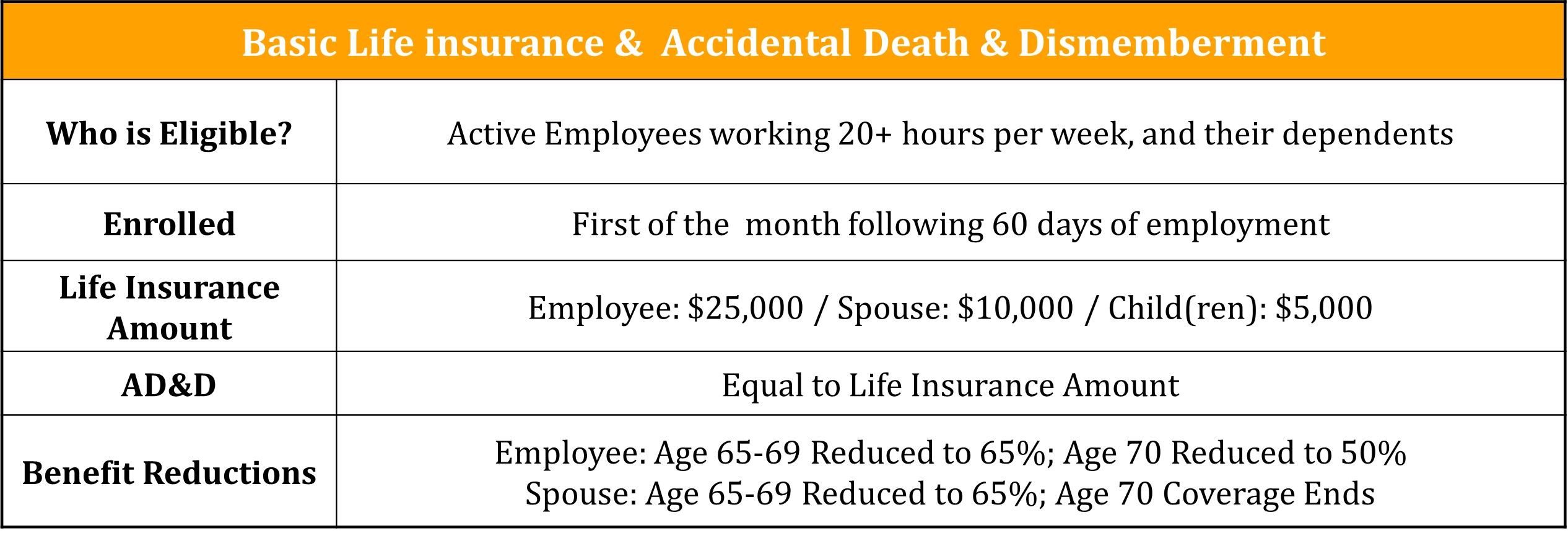

Summary of Group Basic Life and AD&D Benefits and Coverages

Insurance can play an important role in reducing financial stress when a family is faced with the pre-mature death or disability of a wage-earner.

To help employees during critical times of need, through Anthem, Monadnock Food Co-op provides employer paid Life Insurance to all regular employees who work 20+ hours a week.

Basic Life insurance Benefits begin on the first of the month, following 60 days of employment with a benefit amount of $25,000 for employees, $10,000 for spouses and $5,000 for children.

Below is a table outlining the benefit coverage:

Carrier Contact Information

Anthem: Basic Life and AD&D

Customer Service: 800-552-2137

Website: www.anthem.com

Contributions

Group Basic Life and AD&D is 100% paid for by Monadnock Food Co-op.

Disability Insurance

Eligibility

All employees who work 35 or more hours per week are eligible beginning on the first of the month, following 60 days of employment.

Summary of Benefits and Coverages

Most people don’t think about being disabled and unable to bring home their paycheck. Your financial obligations and living expenses don’t stop when you become disabled. Disability insurance can play an important role in reducing financial stress when facing the disability of a wage-earner.

To help you during critical times of need, through Anthem, Monadnock Food Co-op provides employer paid Short and Long-Term Disability Insurance to all employees who work 35+ hours per week.

Short-Term Disability (STD)

- Eligibility is after 60 days of continuous employment

- Employees are automatically enrolled in Short-Term Disability Insurance

- Coverage is 60% of pre-disability weekly earnings to a maximum of $1,000 per week

- Benefits begin on the 1st day of a disabling injury and on the 8th day of a disabling illness

- The maximum benefit period is up to 13 weeks

Long-Term Disability (LTD)

- Eligibility is after 60 days of continuous employment

- Employees are automatically enrolled in Long-Term Disability Insurance

- Coverage is 60% of pre-disability weekly earnings to a maximum of $6,000 per month

- Benefits begin after 13 weeks

Carrier Contact Information

Anthem: Disability Insurance

Customer Service: 800-552-2137

Website: www.anthem.com

Forms & Plan Documents

New plan documents are coming very soon!

Employee Assistance Program & Travel Assistance provided by Anthem

Eligibility

All employees enrolled in the Basic Life Insurance plan provided by Monadnock Food Co-op are eligible beginning on the first of the month, following 60 days of employment.

Summary of Benefits and Coverages

Resource Advisor

Included with your Basic Life or Disability plan is Employee Assistance through Anthem and Resource Advisor. Services included with Resource Advisor are:

- Counseling

- Legal Assistance

- Financial Planning

- ID Theft recovery Services

- Online Tools

- Beneficiary Support & more

24/7 Phone Support: 1-888-209-7840

Online: www.ResourceAdvisor.Anthem.com

Program Name: AnthemResourceAdvisor

Special Offers Discounts

Save money with discounts on Family & Home, Health & Fitness, Medicine & Treatment, Vision, Hearing & Dental.

Log in to your account at www.anthem.com and select the discounts tab.

Travel Assistance

Anthem has teamed up with Generali Global Assistance, Inc. to offer Travel Assistance for members traveling more than 100 miles from home.

You’ll have access to:

- Emergency medical help, such as finding doctors, dentists and health care providers or getting and paying for medical evacuation. All services and transportation must be arranged in advance by GGA.

- Travel services, including getting and sending emergency messages, as well as emergency cash advances.

- Pre-departure information, such as immunization (shots) and passport needs, and travel alerts.

US and Canada: 1-866-295-4890

Other locations (call collect): 1-202-296-7482

Go to www.anthemlife.com for more details

Carrier Contact Information

Anthem: Additional Services

Customer Service: 800-552-2137

Website: www.anthem.com

Forms & Plan Documents

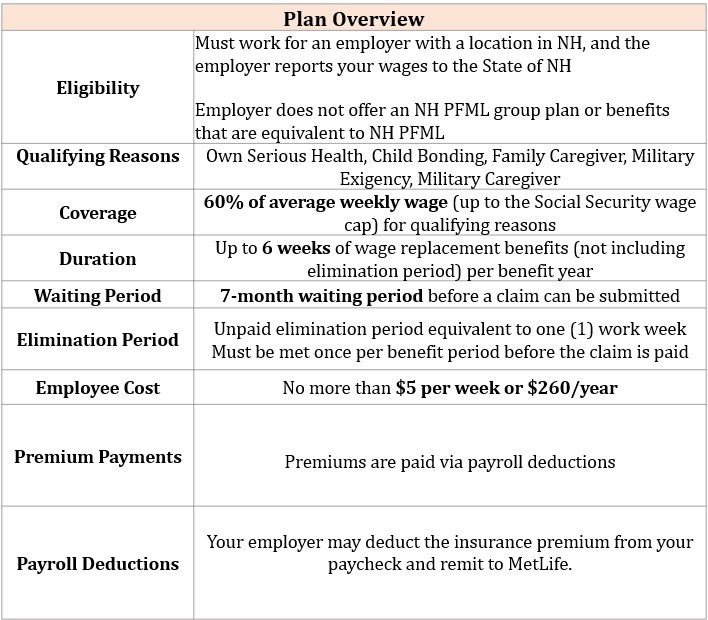

New Hampshire Paid Family & Medical Leave

New Hampshire Paid Family & Medical Leave is a Voluntary Individual insurance program for Paid leave for qualifying reasons. The State of NH PFML insurance partner, MetLife, administers the plan. Open Enrollment is held from December 1st, 2024 – January 29th, 2025. Those who are already enrolled do not need to re-enroll.

Administered by : MetLife

MetLife Customer Solution Center: 866-595-7365

Website: https://www.paidfamilymedicalleave.nh.gov/

Additional Information

SmartConnect- Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/

Additional Information

My Tuition Assistance Benefits

Our tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

Phone: (844) GRADFIN

Website: http://www.gradfin.com/platform/trg

The Wellness Outlet

We offer our employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/